The following page sets out important legal and regulatory information about all materials contained on the SpareBank 1 Boligkreditt AS website (www.spabol.no). This page is designed to prevent unsuitable categories of investors from accessing materials contained on this website. Please read this page carefully before proceeding any further as you will be asked to accept these terms and conditions before proceeding.

BY ACCESSING OR USING ANY PAGE OF THIS WEBSITE, YOU AGREE TO BE BOUND BY THE TERMS AND CONDITIONS BELOW. IF YOU DO NOT AGREE TO SUCH TERMS AND CONDITIONS, YOU SHOULD EXIT THIS WEBSITE IMMEDIATELY.

The information contained on this website does not constitute, and may not be used as, an offer or solicitation to buy or sell securities in the United States or to US Persons or in any jurisdiction or jurisdictions in which such offer or solicitation is unlawful prior to registration or qualification under the securities laws of any such jurisdiction. As a result of these restrictions, you are advised to consult legal counsel prior to making any investment decisions with respect to any materials contained on this website.

The materials published on this website are intended for authorised use only and may not be published, copied or distributed to any other person. The information contained in the materials displayed on this website is highly confidential and may not be disclosed or distributed to anyone without SpareBank’s prior written consent. SpareBank has the right to suspend or withdraw your access to all or any part of this website without prior notice at any time.

You are certifying that (a) by clicking the button "I Agree - 144A" below you are a "Qualified Institutional Buyer" as this term is defined in Rule 144A under the U.S Securities Act of 1933 (the "Securities Act") or (b) by clicking the button "I Agree NON-US" below you are not a U.S person (as defined in Regulation S of the Securities Act) nor are you a resident of or located inside the United States. If you cannot so certify, you must click the button "I Disagree" and exit this website immediately.

Clicking on button “I Agree – 144A” or “I Agree NON-U.S.” shall have the same force and validity as a manual signature and delivery.

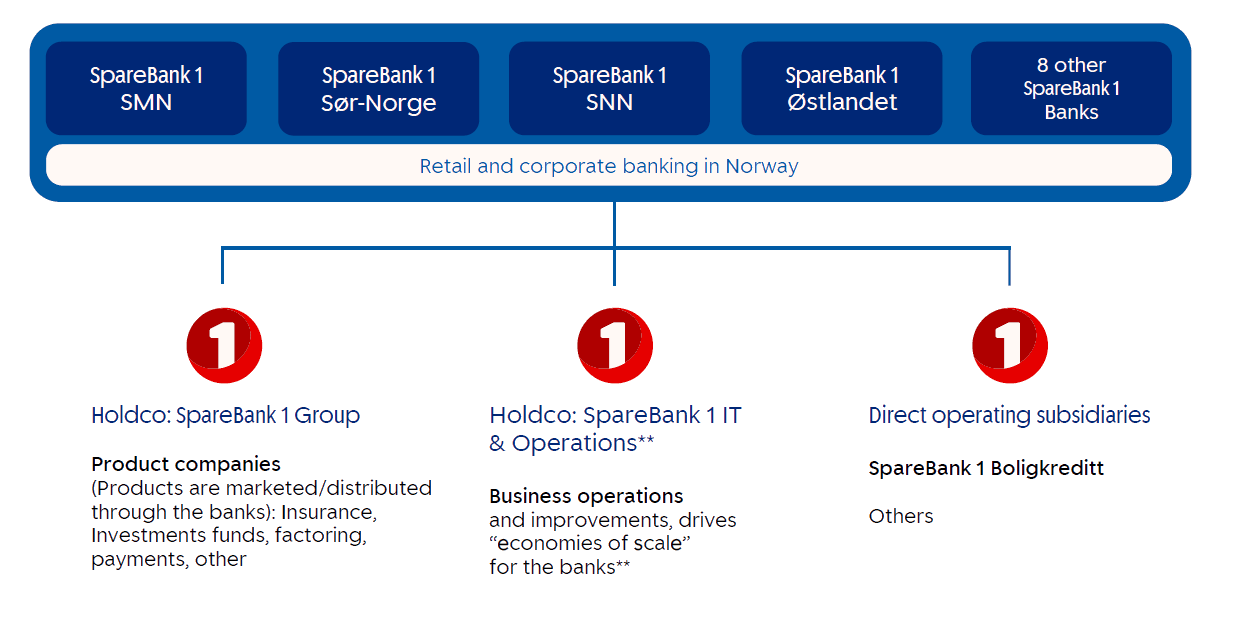

The Alliance is a banking and product collaboration in which the SpareBank 1 banks in Norway closely cooperate. The purpose of the banking alliance is to ensure the independence and regionally anchored position of each bank, as well as their profitability. At the same time, the SpareBank 1 Alliance represents a competitive complete banking alternative at a Norwegian national level. Each member bank carries and promotes the SpareBank 1 brand.

Founding banks were SpareBank 1 Midt Norge, SpareBank 1 Nord-Norge and SpareBank 1 SR-Bank

* SpareBank 1 SR-Bank is not a SpaBol owner bank

** Marketing and distribution, procurement, credit risk models, IT systems, business development projects

Today the SpareBank 1 Alliance consists of 12 banks, which together owns another bank, BN Bank. The Alliance was formed in 1996. Over the years the number of member banks has shrunk, which reflects mergers of institutions within the Alliance.

The SpareBank 1 Alliance is collectively one of the largest providers of financial products and services in the Norwegian market. The SpareBank 1 Alliance is today the leading banking group by market share on the Norwegian residential real estate market. The Alliance has established a national market profile and developed a unison brand. The platform forms the basis for common product and business development amongst the Alliance banks.

The purpose of the SpareBank 1 Alliance is for SpareBank 1 banks to develop and supply competitive financial services and products and to achieve economies of scale. The individual alliance banks are long standing independent financial institutions in Norway, most of which can trace their history back to the early part of the 19th century.

The SpareBank 1 banks operate exclusively in Norway.

Northern Norway is the geographical region of Norway, consisting of the two northernmost counties Troms and Finnmark, in total about 35% of the Norwegian mainland. Some of the largest towns in Northern Norway (from south to north) are Mo i Rana, Bodø, Narvik, Harstad, Tromsø and Alta. Northern Norway is often described as the land of the midnight sun and the land of the northern lights. Further north, halfway to the North Pole, is the Arctic archipelago of Svalbard, traditionally not regarded as part of Northern Norway. SpareBank 1 Nord Norge (or short SNN) is headquartered in the city of Tromsø and ha s75 branches throughout Northern Norway. Other than a significant retail banking presence, the main industries are fisheries, oil and gas exploration and manufacturing, mining and minerals, construction and tourism. The public sector is also a meaningful employer in this part of Norway.

Trøndelag is a geographical region in the central part of Norway. The population in the larger are is nearly 750,000 people or approximately 15% of the Norwegian total. Trondheim is Norway’s third largest city after Oslo and Bergen, and has played a key role in Norwegian history. Today the Norwegian University of Science and Technology is located here. SpareBank 1 Midt Norge (or short SMN) is based in the town of Trondheim. SMN is the region’s leading retail bank by market share. Within the corporate sector the most important activities of the bank is in commercial real estate, transportation and related services, maritime and offshore, seafarming, agriculture and forestry as well as manufacturing, construction and leisure industries.

Western Norway is the region along the Atlantic coast of southern Norway. It has a population of approximately 1.3 million people. The largest city is Bergen, second largest is Stavanger. The area shares a common history with surrounding North Sea countries.

Southern Norway is the name of the geographical region of the Skagerrak coast of southern Norway consisting of the two counties of Vest-Agder and Aust-Agder. SpareBank 1 SR-Bank is based in the city of Stavanger and its home market is in the Western and Southern Norwegian regions. Approximately 25% of Norway’s population live. The dominating industry is oil and gas, but the region is also an important food producer, while finance, investments and renewable energy and technology companies have also grown. The bank maintains the largest market share in the retail segment of all banks active in the region. Within the corporate segment, the largest exposures are to commercial real estate, service based businesses, transportation, agriculture and forestry, hydroelectric power, renewable energy, construction, minerals and mining.

Eastern Norway is the geographical region of the south-eastern part of Norway. It includes the Norwegian capital Oslo. Eastern Norway is by far the most populous region of Norway with approximately 50% of the overall Norwegian population. The SpareBank 1 Alliance is represented by SpareBank 1 Østlandet. A new larger Alliance bank, formed by the merger of 3 previously independent SpareBank 1 Alliance Banks, is SpareBank 1 Sørøst Norge. Both banks are predominantly focused on mortgage lending, with corporate exposures in business services, commercial real estate, transportation, renewable energy and a number of other industries.

The SpareBank 1 Alliance banks cover the whole country with their presence. The focus of the SpareBank 1 banks is primarily on retail (mortgage) lending which makes up approximately two thirds of the aggregated SpareBank 1 balance sheet. The remainder of the loan volume is outstanding with diversified Norwegian small and medium sized enterprises, and for commercial mortgages.

Market shares have grown slowly over the years

The SpareBank 1 Alliance is a banking and product alliance. By participating in it, the independent and locally anchored banks are all linked to and cooperate with each other. In this way, we combine efficient operations and economies of scale with the benefit of being close to our local customers and their local markets. The Alliance model has served the banks well.

In the regions where the largest banks are domiciled, market shares range between 30 to 50% in retail lending and deposits. The same market share applies to the local banks in our local districts. Nationally, due to an underrepresentation in Oslo and surrounding areas where a concentration of the population resides, the market share in residential mortgages is approximately 20%.

The SpareBank 1 Alliance is the second largest lender by assets in Norway. The following chart shows the outstanding balances in retail lending as of year-end 2020.

Please find below the direct links to the investor relations pages in English for the four largest SpareBank 1 Boligkreditt parent banks. These banks are rated by Moody's (A2) and Fitch (A and A-) and represent approximately 80% of the total assets of the SpareBank 1 Alliance as a whole.

| Issuer ratings | Moody’s | |

|---|---|---|

| SpareBank 1 SMN | Aa3 / P-1 | |

| SpareBank 1 Nord-Norge | Aa3 / P-1 | |

| Sparebank 1 Østlandet | Aa3 / P-1 |

SpareBank 1 Boligkreditt is a labelled covered bond issuer. Details of the label and information on SpareBank 1 outstanding covered bonds are available on the European Covered Bond Council (ECBC) covered bond label webpage:

www.coveredbondlabel.com